cumulative preferred stockholders have the right to receive

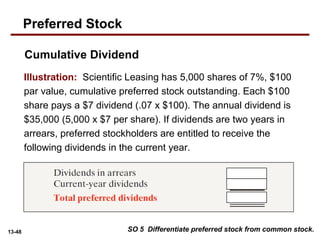

The startup must pay cumulative preferred stockholders 600 for every two years that dividends. Choo Cumulative feature Enables stockholders.

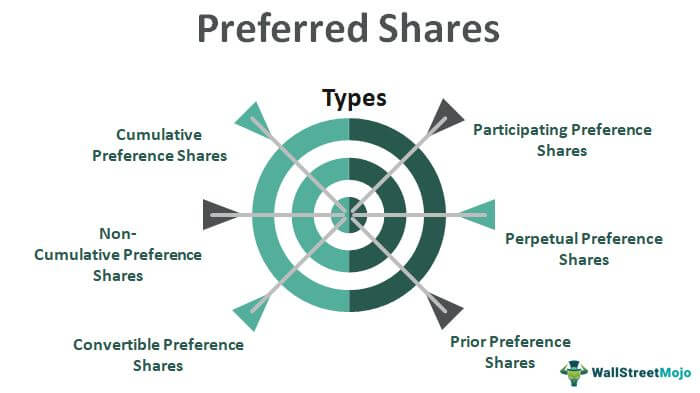

Preferred Shares Meaning Examples Top 6 Types

If the dividends are delayed for more than six consecutive quarters the shareholders.

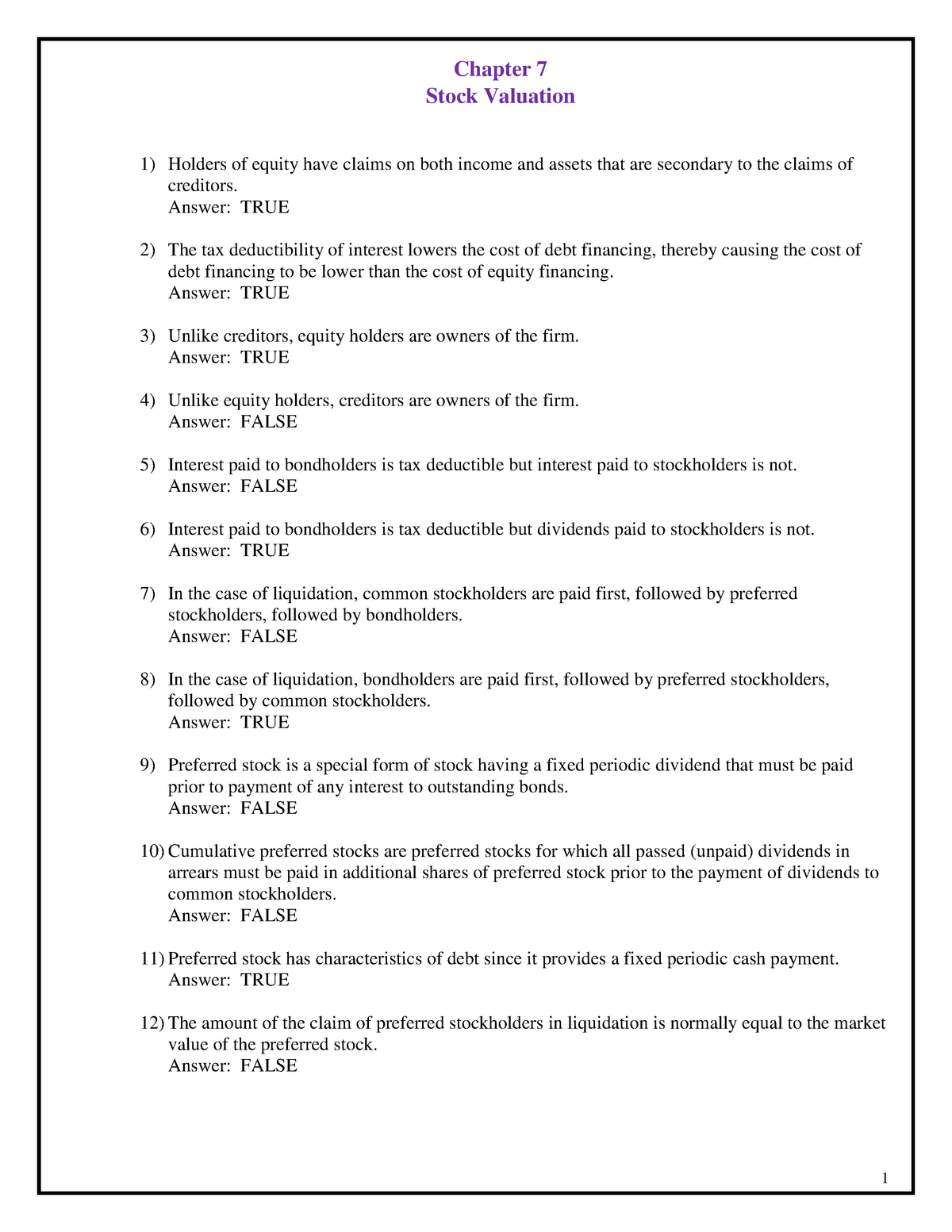

. Cumulative preferred stocks right to receive dividends is forfeited in any year that dividends are not declared. CHAPTER 12 - CORPORATIONS. Corporations call in preferred stock for many reasons.

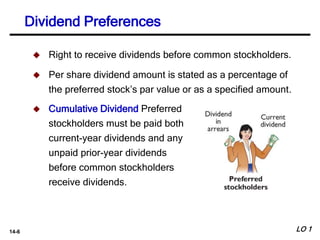

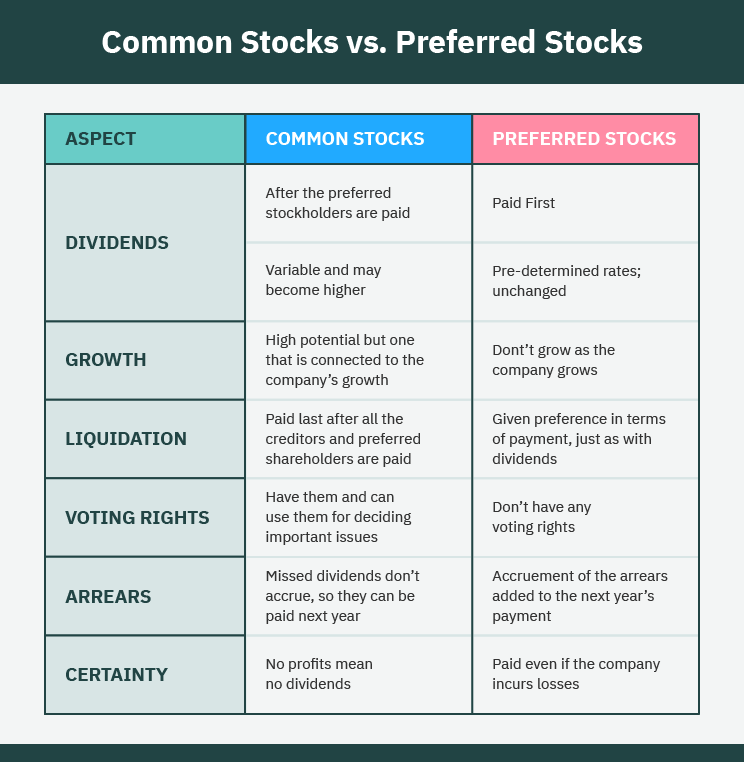

It is a reliable source and is valued among investors. Cumulative preferred stock is preferred stock for which the right to receive a basic dividend accumulates if the dividend is not paid. Cumulative Preferred Stock stockholders have the right to receive dividends in arrears their.

It means that cumulative preferred shares are important that the noncumulative. Preferred stockholders have a right to receive current and unpaid prior-year dividends before common stockholders receive any dividends. The shareholders will receive the.

Cumulative preferred stockholders have the right to receive a. Cumulative preferred stocks are entitled to receive all the missed unpaid dividends. Cumulativenoncumulative preferred stockholders have a right to be paid both the current and all prior periods unpaid dividends before any dividend is paid to common stockholders.

In some cases the cumulative preferred stock holder has a right to receive unpaid dividends. Preferred stockholders have the right to receive dividends to strears those not paid in prior years promised prior to common stock dividends being paid. If the preferred stock is cumulative preferred.

A greater share of dividends than. Preferred shares are the most common type of share class that provides the right to receive cumulative dividends. As soon as all the cumulative preferred shareholders.

Dividends in arrears after common stockholders are paid. Cumulative Preferred Stocks are a type of preferred stock that abides the company to pay all the dividends for this type of shareholders before paying any other shareholder of the company. ORGANIZATION STOCK Previous Page 4 of 6 Next Cumulative preferred stockholders have the right to receive O a.

One of these rights may be the right to cumulative dividends. However noncumulative stocks undeclared dividends accumulate each year until. Non cumulative preferred stock does not have this right arrears cumulative preferred stock.

1 the outstanding preferred stock may require a 12 per cent annual dividend at a time when the company can secure capital to retire. If a company is unable to distribute dividends to shareholders. This type of preferred stockis oled.

Preferred stock shareholders already have rights to dividends before common stock shareholders but cumulative preferred. However they owe cumulative preferred stockholders dividends from the previous two years. Has a right to receive regular dividends that were not declared paid in prior years.

In this case the cumulative preferred stockholders must receive 900 in arrears in addition to the current dividend of 600 as of that time. A greater share of dividends than common stockholders.

Accounting For Cash Dividends Non Cumulative Preferred Stock Youtube

Preferred Stock Explained 2022 Everything Investors Need To Know

Preferred Shares Meaning Examples Top 6 Types

What Is Cumulative Preferred Stock Stocks Trading Insights

Accounting Test 1 Chapter 14 Part 3 Flashcards Quizlet

What Is Cumulative Preferred Stock Stocks Trading Insights

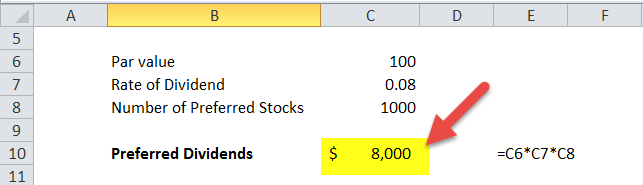

Preferred Dividend Definition Formula How To Calculate

Preferred Shares Meaning Examples Top 6 Types

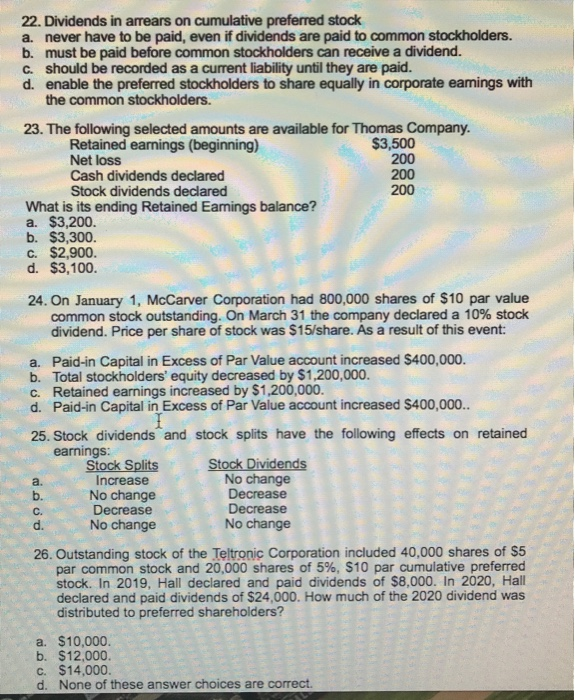

Solved 22 Dividends In Arrears On Cumulative Preferred Chegg Com

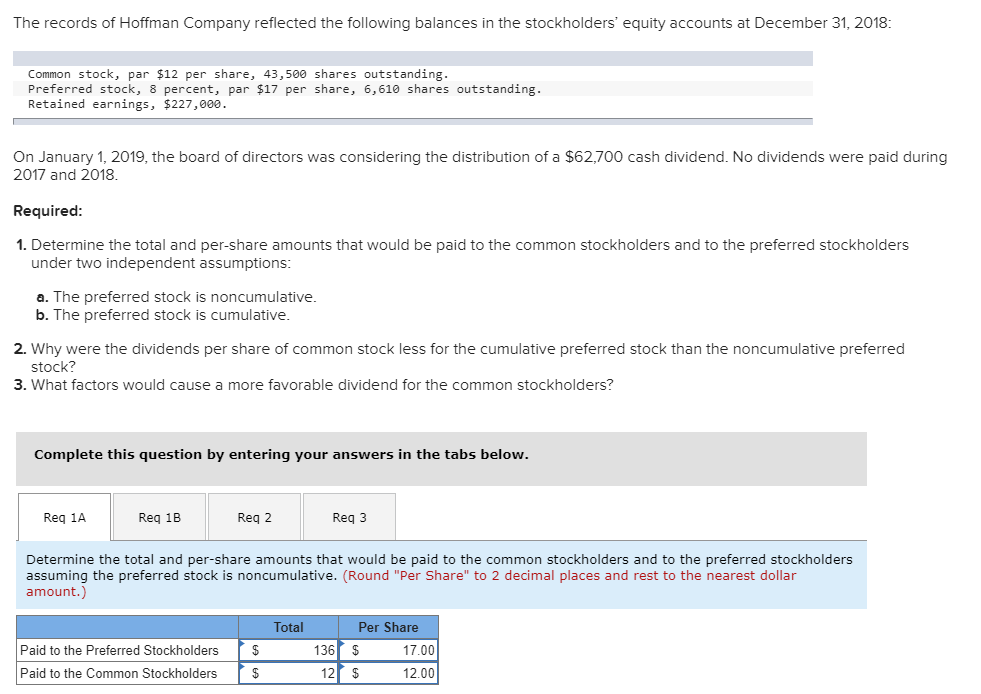

Answered The Records Of Hoffman Company Bartleby

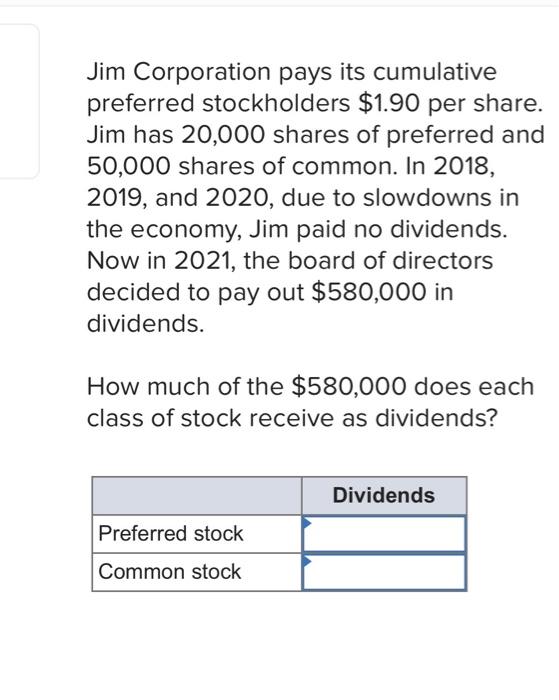

Solved Jim Corporation Pays Its Cumulative Preferred Chegg Com

Preferred Shares Types Features Classification Of Shares

:max_bytes(150000):strip_icc()/Term-Definitions_preference-shares_FINAL-3318dcb09d1b43389aa88dfd6f79420f.png)

What Are Preference Shares And What Are The Types Of Preferred Stock

Preferred Stock Vs Common Stock Which Is Better Candor